Messages from Scholars about History and Culture

A Brief Survey of US Accounting

Article Excerpt with Reflection

Aida Sy and Anthony Tinker

1. Background

From the 1400s to 1600s, European nations developed bookkeeping and accountancy to help run their companies efficiently, control vital trade, track money extracted from their colonies, and collect taxation to finance wars. This era has come to be called the mercantilist period or simply mercantilism. Bodin, Colbert, Mun, Misselden, Malynes, Child, Stuart, and Serra were the companies’ top managers and lawmakers during this era (Smith, 1776; Heckscher, 1935; Keynes, 1936; Schumpeter, 1954; Britannica, 2022). Thus, America was still a British colony when bookkeeping arrived on our shores.

2. Role of Accounting in the Development of US Railroads

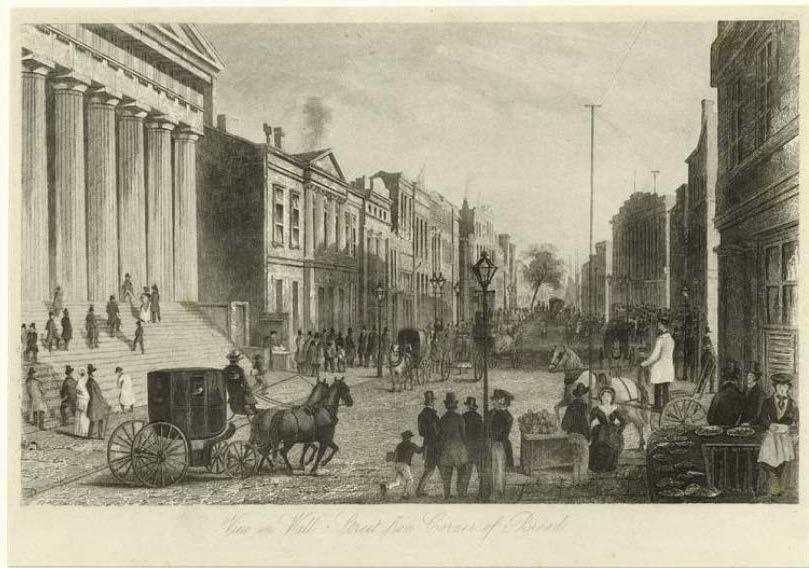

The development of railroads was vital to the growth of the US economy, as companies needed an effective transportation infrastructure to bring workers and supplies of raw materials to factories (Van Oss, 1893; Sobel, 1968). The US railroad system was financed through stocks, bonds, and government funding – another link to accounting. (Van Oss, 1893; Sobel, 1968).

3. Early Financial Statements and the Recognition of the Accounting Profession in the US

“Financial accounting” is defined as the sales and purchases of a company. Roberts (2020) and Capozzoli and Teed (2016) investigated the role of accounting during and after the Civil War. Goldsmith (1982) studied the history of the US balance sheet. Today, the Generally Accepted Accounting Principles (GAAP), established by the Financial Accounting Standards Board (FASB), provides the accounting standards with their definitions and concepts. When accountants set up accounting policy for a company, they follow GAAP’s rules.

Growth is essential for the survival of all market economies, as market forces compel firms to invest in new levels of cost saving and more productive technologies. Accounting information aids economic growth. How? Investors make investments according to a Price: Earning Ratio (the P: E ratio): price (share or stock price) is what you pay; earnings are what you get in return. Accounting studies focus on measuring “earnings potential” and its quality. Accountants use the “past earnings record” (a summary of transaction) to estimate future “earnings potential.”

Here are four standard financial statements:

- The balance sheet (snapshot at a point in time)

- The income statement (a periodic summary of transactions, usually a year’s worth)

- The cash flow statement (a periodic summary of transactions, usually a year’s worth)

- The statement of retained earnings (a periodic summary of transactions, usually a year’s worth)

Let’s focus on the past earnings record. Accounting transactions are composed of exchanges: buying transactions (recorded as a firm’s expenses) and selling transactions (recorded as firm’s sales revenues). Written as a formula:

REVENUES – EXPENSES = PROFIT (EARNINGS)

This is the “E” in the P: E ratio that investors use in buying securities, aiding economic growth, and averting social unrest.

The methods that accountants use to measure, calculate, and report buying and selling transactions are so important that specific institutions are empowered to set regulations for calculating and reporting transactions. These institutions include the Securities and Exchange Commission (1933-34 Acts), the Public Corporate Accounting Oversight Board (2002 SOX legislation), and the Financial Accounting Standards Board.

These regulatory institutions emerged because those who produce the transactions records (management) sometimes manipulated the reported information to their own benefit. Insider (management) stockholders’ gain at the expense of outsider shareholders created a crisis of confidence in the investment and growth process. The most noteworthy examples of such fraud include the Savings & Loans crisis ($400 billion), Tyco ($60 million), Enron ($4 billion), WorldCom ($12 billion), Xerox ($10 million), Vivendi ($12 billion), and Pamalot ($20+ billion).

The so-called “Big Eight” big accounting firms—Arthur Andersen; Arthur Young; Coopers & Lybrand; Deloitte Haskins & Sells; Ernst & Whitney; Peat, Marwick, Mitchell; Price Waterhouse; and Touche Ross—developed in the 1980s. Due to mergers and alliances, the Big Eight firms became the Big Four.

The continuation of the development of accounting in the US is evidenced by the appearance of cost accounting (see Charles T. Horngren’s, Cost Accounting). Alfred Sloan and General Motors were able to compete with Henry Ford in the 1920s in part by using advanced cost accounting techniques.

4. The Securities Exchange Commission, SEC, and the Importance des Regulations

The American accounting profession has created several organizations since the Great Depression that sets standards for its members. New tools were needed and have been created.

Reflection

On the Difficulty of Doing Research in a Real-World Discipline like Accounting

For this article, we researched the development of US accounting system. Most readers are familiar with accounting as a discipline more than as a practice. When we talk of our research to colleagues outside the business school, we are surprised by their lack of knowledge of accounting research. Unlike other disciplines such as philosophy, economics, English, or physics, accounting has no established theories. As a result, researchers in accounting have to build a framework and borrow theories from other disciplines. Our main difficulty in writing this article was having to build a theory by borrowing from a discipline. We spent many months searching. Finally, we concluded that the best approach to explain the development of US accounting was to use an historical approach.

Another challenge we faced was how to present so many accounting facts to a general reader, one who has little or no background in accounting research. One of our goals was to convey the importance of regulations, as the US financial market is one of the most regulated institutions in the world. This is important because it makes it the most secure place to invest, resulting in its ranking as the number one financial market in the world.

Finally, another difficulty we experienced was limiting the number of accounting and economic facts since America was founded. In revising the paper, we removed some parts that were in the earlier draft, as we needed more time to do additional research. This explains why the paper is short. In fact, we encourage future researchers to write more papers on our topic.

How to Attract the Reader’s Interest

We will have no problem convincing investors to read our paper. However, as our goal was to reach a larger audience, we needed to adjust our content. We aimed for general readers because we believe that accounting is a part of America’s creation, for accounting is business. In fact, accounting is called “the language of business.” As the American Accounting Association put it during its conference in 2013, accounting is “Connecting People.” Therefore, we believe that accounting should be investigated by a large audience.

The Sources We Used

We read US economic facts, corporations archives, and the SEC website regarding regulations of the financial markets. We also read US Congress publications on business and accounting laws passed under various American presidents and did a literature review about the topic. This part of our research was time consuming. We next selected the material germane to our thesis.

Limitations and Further Research

As we said early in this reflection, the topic is so large that we had difficulty limiting our paper. We strongly encourage scholars to continue to write on US accounting history. We also encourage collaboration between different disciplines. There is precedence for this, as we were certainly not the first to write about the history of US accounting. The work of Littleton, Previts, Merino, Zeff, and others began US accounting research.

References

Britannica. (2022, December 1). Mercantilism. Encyclopedia Britannica. Retrieved February 9, 2023, from https://www.britannica.com/topic/mercantilism

Capozzoli, E. A., & Teed, D. G. (2016). Post-civil war accounting practices in natchez, Mississippi. Accounting Historians Journal, 43(2), 39-58.

Edey, H. C. (1969). Accounting Principles and Business Reality. In B. V. Carsberg & H. C. Edey (Eds.), Modern Financial Management. Penguin.

Garner, S. P. (1974). Reflections on the uses of accounting history. Accounting Historians Journal, 1(1). https://egrove.olemiss.edu/aah_journal/vol1/iss1/1

Goldsmith, R. W. (1982). The national balance sheet of the United States, 1953-1980. University of Chicago Press.

Heckscher, E. F. (1935). Mercantilism. Allen and Unwin.

Horngren, C. T., Datar, S. M., & Rajan, M. V. (2014). Cost Accounting: A Managerial Emphasis (15th ed.). Pearson.

Keynes, J. M. (1936). The General Theory of Employment, Interest and Money. Allen and Unwin.

Littleton, A. C. (1933). Accounting Evolution to 1900. American Institute Publishing Company.

Previts, G. J., & Merino, B. D. (1998). A History of Accountancy in the United States: The Cultural Significance of Accounting. Ohio State University Press.

Roberts, D. H. (2020). US Public Accounting Practice and Intergenerational Occupation Transfer 1850–1870. Accounting Historians Journal, 47(2), 21-33. https://doi.org/10.2308/AAHJ-17-006

Schumpeter, J. A. (1954). History of Economic Analysis. Allen and Unwin.

Smith, A. (1776). An Inquiry Into the Nature and Causes of the Wealth of Nations. Strahan and Cadell.

Sobel, R. (1968). Panic on Wall Street: A History of America’s Financial Disasters. Macmillan.

Sy, A., & Tinker, T. (2005, March). Archival research and the lost worlds of accounting. Accounting History, 10(1), 47-69. https://doi.org/10.1177/103237320501000103

Trollope, A. (1941). The Way We Live Now. Oxford World Classics.

Van Oss, S. F. (1893). American railroads and British investors. Effingham Wilson & Co., Royal Exchange. https://archive.org/details/americanrailroad00vanorich

Zeff, S. A. (1983, January). A Retrospective. The Accounting Review, 58(1), 129-134. https://www.jstor.org/stable/246647

Further Reading:

Baxter, W. T. (2004). Observations on money, barter and bookkeeping. Accounting Historians Journal, 31(1), 129-139.

Brown, R. (2014). A history of accounting and accountants. Routledge.

Degos, J. G. (1998). Histoire de la comptabilité. Presses universitaires de France.

Mattessich, R. (1964). Accounting and analytical methods, Richard D. Irwin. Inc, Home wood, Illinois.

McCormick, T. (2009). William Petty: And the Ambitions of Political Arithmetic. United Kingdom: OUP Oxford.

Yamey, B. S. (1981). Some reflections on the writing of a general history of accounting. Accounting and Business Research, 11(42), 127-135.